Zhao’s response to why liabilites were not publicised was that “liabilities are harder”, and simply said to “ask around” for proof that “we don’t owe loans to anyone”. In truth, there is not much point proving reserves when the amount of liabilities are unknown, and the market did not react well to the omission. Despite publicly pushing for proof of reserves declarations, Binance’s attempt to present finances to the world was lacking, omitting liabilities entirely. The charges are hefty, including alleging Binance “failed to implement basic compliance procedures designed to prevent and detect terrorist financing and money laundering”.ĬEO Zhao also was forced to dispel concern around the company’s lack of transparency in the wake of the FTX collapse last November. customers from trading on its platform, Binance instructed its customers – in particular its commercially valuable U.S.-based VIP customers – on the best methods for evading Binance’s compliance controls”. The complaint alleges that “even after Binance purported to restrict U.S. Shortly after, the Commodity Futures Trading Commission (CFTC), charged Binance and high level executives, including CEO Changpeng Zhao, for leading an “intentionally opaque common enterprise”. The regulatory trouble has not stopped there. Second place went to Coinbase, toiling with far behind with an 8.2% share.

Nearly every other major exchange lost market share last year (with the exception of ByBit), showing that despite capital fleeing from the industry at large, Binance was eating up all before it.

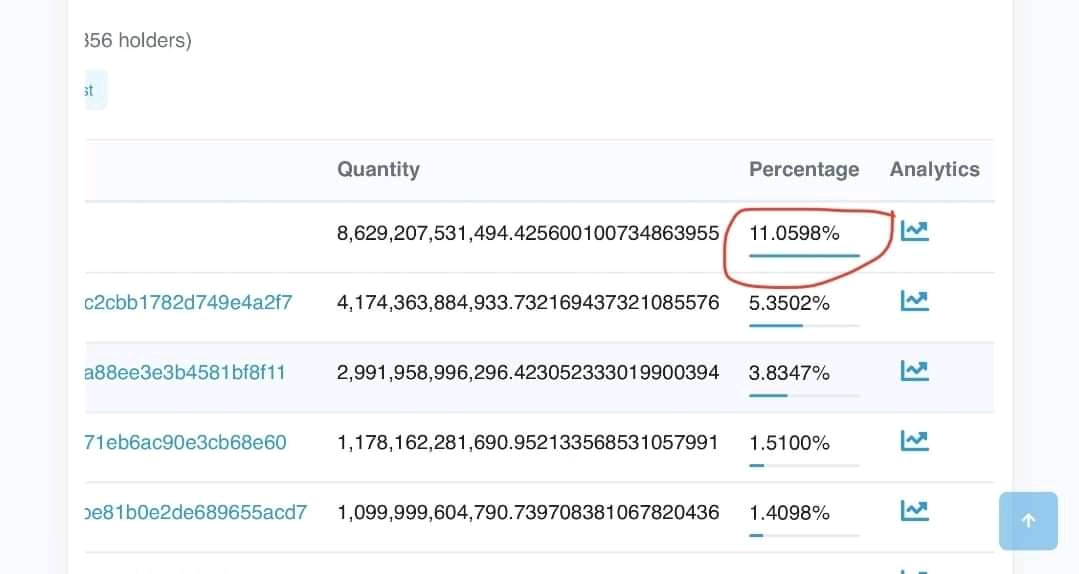

The surge in market share came despite overall trading volume falling 45% during the year 2022, spot trading coming in at $5.29 trillion on Binance. Binance began 2022, when all was well in the crypto world and the phrase “bear market” had not entered the lexicon yet, with a 48% market share. At the end of last year, CCData reported that Binance’s share of trading volume on centralised exchanges was a staggering 66%. The world’s biggest cryptocurrency exchange dominates the landscape. A round of layoffs is planned at the company, following in the footsteps of many companies around the industry.Exchange has landed in hot water over a multitude of regulatory issues, while lack of transparency has caused concern in market.Binance’s share of trading volume is at 48%, despite being 66% at the start of the year.

0 kommentar(er)

0 kommentar(er)